- #YNAB BUDGETING REIMBURSEABLE EXPESES HOW TO#

- #YNAB BUDGETING REIMBURSEABLE EXPESES FULL#

- #YNAB BUDGETING REIMBURSEABLE EXPESES FREE#

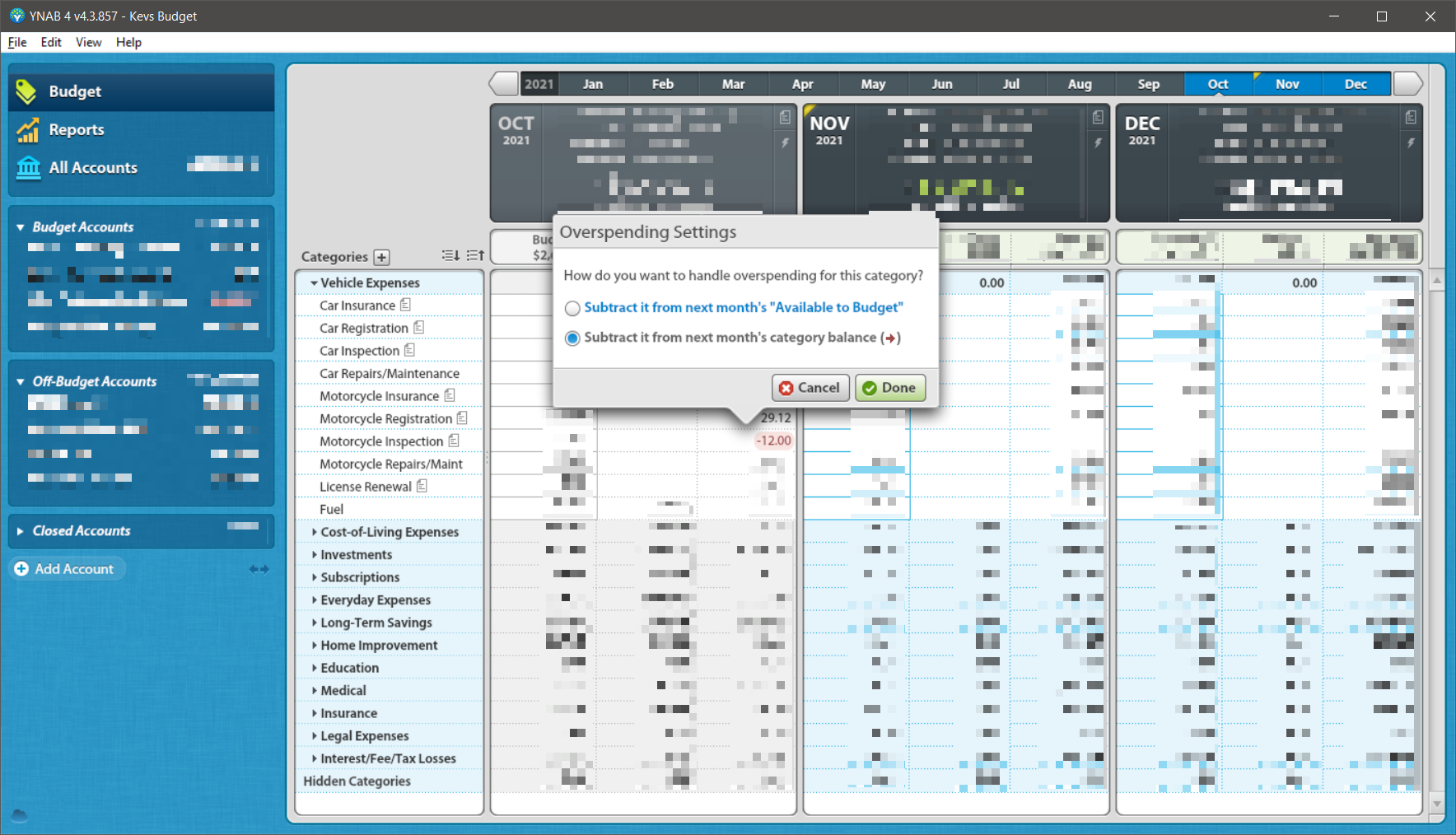

You know exactly how much you have to work with and where it should go. With zero-based budgeting, there is no guesswork. Zero-based budgeting gives you the flexibility to buy all the lattes you want… or whatever extra expenditures you have… while showing you how those lattes will affect what you have to put towards other expenses. See, what happens for a lot of people is that they approach debt and savings by saying, “I’ll take care of that with what’s leftover at the end of the month.” In that lies a problem, because unless you make a point to use a certain amount of money for savings or debt payments, it’s really freaking easy to have nothing left at the end of the month. Zero-based budgeting teaches you that you are in control of every dollar you are earning, and it’s incredibly effective for people who want to pay off debt and/or build their savings. YNAB uses zero-based budgeting, or what they call budgeting to zero. These rules are meant to alter the way you approach spending, saving, and even thinking about money. These rules are the core of the YNAB app, and they are why many users consider YNAB to be a complete game-changer. It’s easier said than done, but working the other three rules is meant to help you stop living a paycheck-to-paycheck lifestyle. The purpose of this rule is to help you start living on last month’s income. This rule is about flexibility and teaches you that it’s okay to move money around when you need to. It’s easy to overspend in some categories, and some expenses require fewer funds than you allocate money towards. Realizing that you will have some less-frequent expenses, like holiday spending or vacations, you set an amount to spend on those and save up for each. The idea is to prioritize the money that’s coming into your accounts to everything from household and living expenses, savings, and debt. You take the money you earn and allocate every single dollar you make to different expenses.

YNAB is solely a budgeting app, and it was built on a few seemingly simple rules: It was founded in 2004 after real-life couple Jesse and Julie Mecham realized they needed a better system to budget their money.

#YNAB BUDGETING REIMBURSEABLE EXPESES HOW TO#

How to Handle Taxes for Your Side Hustle.

#YNAB BUDGETING REIMBURSEABLE EXPESES FREE#

Free Blog Installation and Setup Service.How to Make Money as a Pinterest Virtual Assistant.Learn How to Become a Virtual Assistant.How to Find Virtual Assistant Jobs for Beginners.Work from Home Jobs with No Startup Fee.Subscriptions may be managed by the user and auto-renewal may be turned off by going to the user’s Account Settings after purchase.Account will be charged for renewal within 24-hours prior to the end of the current period.Subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.YNAB is a one-year auto-renewable subscription, billed monthly or annually.Monthly or Annual Subscriptions Available.

Tired of timing bills to pay day? Frustrated that you make OK money, but have nothing to show for it? The YNAB budgeting app and its simple four-rule method will help you demolish your debt, save piles of cash, spend without guilt, and reach your financial goals faster. Ask our extremely friendly, incredibly helpful support team your budgeting questions anytime via email or live chat.

:max_bytes(150000):strip_icc()/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

When you open your budget app, it’s just that-your budget. We don’t pitch you recommended products in-app.

#YNAB BUDGETING REIMBURSEABLE EXPESES FULL#

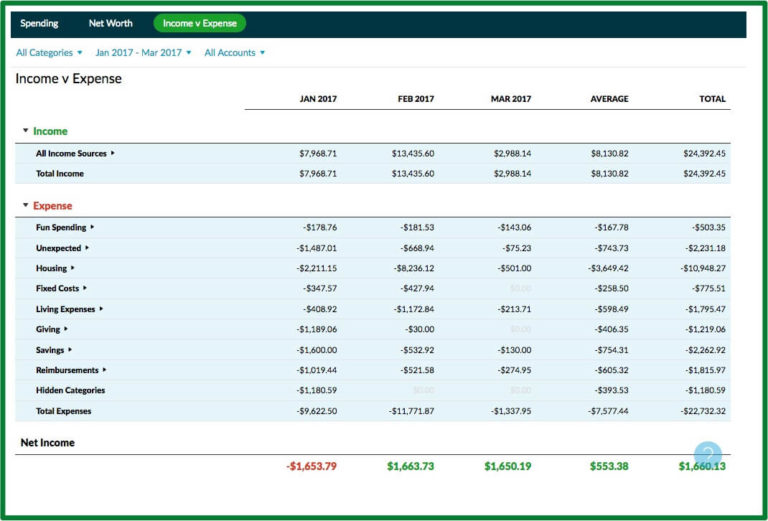

See your average grocery spending (down to the cent) and your growing net worth in full technicolor glory. Visualize your spending and progress with budget reports. Create categories for your financial goals and big purchases, and see your growing progress at a glance. Turn your financial goals into reality with our powerful goal-setting features.

We’ll calculate the interest and time saved for every extra dollar put toward debt. Find more money and motivation for your debt payoff with our loan planner tool. View changes to your budget in real time across devices, making it simple to share finances with a partner. Securely link your accounts and see your complete financial picture in one place. Gain total control of your money with YNAB. See a complete view of your personal finances. Pay off more debt, grow your savings, and reach your goals faster. On average, new budgeters save $600 in their first two months and more than $6,000 their first year. Get a handle on your personal finances by budgeting with YNAB-a proven method and budgeting app that gives you real results.

0 kommentar(er)

0 kommentar(er)